In the internet age, we have access to more information than ever before. However – while this technology has proved greatly beneficial – it has also led to a variety of problems. For example, ‘fake news’ is not just limited to media coverage but also spread to how we process information.

This includes how we manage our finances. Navigating this world can be challenging to begin with but there is so much misinformation about credit scores out there that we keep hearing the same myths again and again.

Hopefully, we can now put some of these falsehoods to rest while clarifying those which will have any sort of impact on your credit score.

Your credit score explained

First, let’s explain what your credit score actually is. While we’ve covered this in detail within our help and advice section, your credit score basically indicates how much of a potential risk you could be to lenders.

The higher your credit score generally is, the more responsible you will appear to these organisations. Negative elements such as missed bill payments, multiple credit cards, or county court judgements can reduce this figure and might prevent you from obtaining certain financial products.

We also have a range of hints and tips if you want to repair a poor credit score.

Top myths about credit scores

Although there’s a substantial amount of information out there related to credit scores, we continue to hear inaccuracies about what influences these figures. We’ve detailed those we hear most often below:

Every person has one credit score

False. Nobody has a single credit score or rating that is used to assess their eligibility for credit; instead, credit checks are completed at the discretion of each credit provider. This means that people can have multiple scores at any one time, depending on the individual criteria of each agency.

These credit scores vary as different agencies operate on unique scoring models. Regardless, the higher these figures are, the better financial products you should have access to.

Previous occupants of your house can affect a credit score

False. It’s a common misconception that the previous occupant of your property can impact your credit score, or that the credit history of a particular house somehow passes over to the next person who moves in.

These days, credit checks are conducted on individuals, rather than addresses. In most cases, your personal credit score does not factor in the financial situation of others, unless you have received approval for a joint credit application or are financially associated with another person.

Never borrowed money? You will have a good credit score

False. Although it’s logical to think that if you’ve never had the need to apply for credit then you must have a tight handle on your finances, this doesn’t necessarily mean you will have a good credit score.

When assessing any application for credit, most lenders are keen to see evidence that a person has borrowed money in the past and has been able to pay it back on time. Many people look to solve this issue by taking out a credit card, not because they need the extra funds, but because they can use it to build a history of well-managed credit repayments.

Bad credit lasts forever

False. Many people are worried about the future impact of their credit decisions, particularly if they have missed repayments in the past.

The good news is that credit checks are designed to be an accurate and detailed picture of a person’s current financial situation, and so the majority of lenders will only take into account credit information within the past six years.

Checking your credit report harms your credit score

False. Checking your credit report will not adversely affect your credit score. Although there are paid and free ways to do this, you can request this check as many times as you like to observe fluctuations in your score.

When lenders are assessing how much of a potential risk you are, they will take into consideration the applications for financial products left on your report. Events such as a soft credit enquiry (when credit is not investigated as part of a lending decision) or checking your credit score will not factor into this analysis.

Therefore, as long as you are not routinely applying for products in order to determine your score, you won’t be adversely affected by making regular checks.

Employers can check your credit score

False. One of the most prevalent myths about credit scores states these figures can be reviewed by an employer. This is not true and the problem likely arises from individuals using the phrases ‘credit report’ and ‘credit score’ interchangeably.

Although an employer can review your credit report, this differs from the one typically seen by lenders and is often used to indicate how financially responsible a worker is – especially so if the job requires handling large amounts of funds.

Furthermore, he or she cannot do this on a whim. If an employer seeks to review your credit report (not all employers would want to) you must give written consent.

You can be on a credit blacklist

False. There is no such thing as a credit backlist. We can assume that if such a document did exist (and you were on it) you would be banned from borrowing funds and find it extremely difficult to be removed.

If someone is turned down repeatedly for financial products, he or she might assume they are on a blacklist – which is probably how the rumour started. However, there are lots of factors which can influence how likely an application is to succeed.

If that individual worked on improving their credit score, they would soon realise that they haven’t been blacklisted by lenders at all.

When applying for a loan, mortgage, or credit card, your credit score will typically be evaluated to determine how safe a borrower you are. During the check itself, a variety of potential factors will be reviewed. These could include:

- Your name and date of birth.

- The value and length of any loans, credit cards, or mortgages taken out in that person’s name.

- The conduct of these loans. For example, highlighting if any payments were missed.

- Your history of utility bill payments, phone bill payments, and other bills.

- Your history of previous loan applications.

- Your payment profile – if there have been any late payments or if payments have been made on time.

Depending on what credit score you have, this will have a bearing on what sort of financial products you can obtain. Those with an extremely low credit score may struggle to gain access to any sort of loan – or might be required to pay higher rates.

What is a bad credit score?

When lenders are evaluating credit scores, they will do so against a scale. Although variations exist across agencies, Experian’s scale ranges between 0 and 999. Under those measurements, a score of 881 or more is classified as ‘good’. A credit score under 720 though is described as ‘poor’.

When determining these scores, certain aspects of a person’s history will have greater weighting than others. For example, according to Experian, the most important factor is an applicant’s payment history – making up around 35% of the total score.

Regardless, if your credit score falls within the ‘poor’ range, this is no cause for despair. The good news is these ratings can be improved with some hard work.

How to fix a bad credit score

The first step to fixing a poor credit score is determining where the problem lies. As mentioned earlier, this rating takes a variety of factors into account so learning which one negatively affects your score is a great step in the right direction. Therefore, before doing anything, you should request to view your credit report.

Once obtained, you should review it in detail to determine that the information is accurate.

The importance of fixing inaccuracies

Although inaccuracies might include basic errors, such as incorrect address details, reviewing this report can also identify fraudulent activities.

If someone has made an application for a loan in your name, then this could have a detrimental effect on your credit score. Although this should be reported immediately, other mistakes ought to be highlighted to the organisation which supplied the original information.

You may also choose to add a ‘notice of correction’ as a way to highlight extenuating circumstances. For example, hospitalisation preventing you from working and, therefore, causing you to miss a mortgage payment.

How else can I improve my credit score?

Once you’ve determined how accurate your credit report is, you can begin to take steps to improve it. Fortunately, they are a variety of ways you could do this:

- Paying bills on time. It sounds obvious, but this is a great way to demonstrate your trustworthiness to potential lenders.

- Resolve your debts. It is advisable to clear your debts before taking on additional finances as well as closing any unused credit cards. Clearing this may make you more attractive applicant to some lenders.

- See who you share accounts with. You might have a spotless credit history, but does your spouse? If your credit report is linked with a person who has a poor credit score, you might find it harder to obtain a good deal. In this situation, that individual could benefit by taking some of the steps mentioned here.

- Reduce the number of credit cards. Having too many cards may be seen as an inability to effectively manage your finances without resorting to multiple credit options.

- Get on the electoral register. This is important as the electoral register is one of the best ways for lenders to check/confirm your information.

- Build your credit history. Even if you have no debts, you might have a poor credit score as there is no record of responsible payment. In this situation, applying for a credit card or credit-builder loan could help rectify this.

- Seek advice from the Money Advice Service, an independent service set up to help people manage their money.

How long will it take to improve my credit score?

Sadly, there is no quick way to do this. Potentially, it might take months or even years before you improve your credit score. However, in many ways, this can be viewed as an opportunity.

Improving a credit score is a marathon, not a sprint. Much like how the best runners don’t immediately start with a challenging event, taking small steps now will likely yield more positive results in the future.

Therefore, start slow. Understand the points in your credit report and strive to improve these one at a time. Alternatively, if your debts are getting on top of you, consider professional advice or consolidating your loans into affordable monthly repayments.

Whether you plan on selling your house in the near future – and want to set a higher asking price – or you simply need a bit of a change in your day-to-day living, there are plenty of options to consider when it comes to home improvement.

Of course, every person or family has their own distinct priorities. You may need to replace a faulty oven, create more space within the house, redecorate a particular room, or even transform the garden into a liveable space. While any increase in total market value depends on how much you choose to invest in the first place, everybody can do a few things to get the ball rolling. In this guide, we will look at some of the factors which can influence property value as well as suggest a few small tweaks which can go a long way.

How can location affect the value of my home?

First, let’s focus on something you can’t change – where your home is based. The effect of location on property values can vary depending on a number of external factors. For example, living in an area with an excellent local economy which features a good community spirit can do wonders for property prices. In a similar fashion, if a school is due to be built near you, the value of your home could increase.

One report, published in the Independent, highlighted the effects of having a supermarket on your doorstep. According to the report, living near a Waitrose could add more than £36,000 to the value of a home. In fact, being in close proximity to any major supermarket may improve property prices by approximately £22,000.

This has lead to some individuals describing this as the ‘Waitrose effect’.

In 2017, an article in the Guardian highlighted the areas of the UK where property prices were increasing. Over a 12-month period, the North West saw the greatest hikes with a seven percent gain in house values. In contrast, the value of homes in London had a regional increase of 2.5%.

Therefore, although you can’t change where your property is based, there are external factors which can affect its value. As well as spotting the addition of amenities such as a supermarket, This is Money has highlighted other factors.

For example, according to the organisation, the arrival of niche food chains – such as delicatessens – can be a sign that the local population is becoming more affluent and will have more disposable income.

Furthermore, an increasing youth population can be positive. Afterall, the publication argues, the majority of these will be young professionals who require access to transport links and local businesses. As a result, this demand will bring these organisations to the area and improve the area – increasing house prices as a result.

However, be aware that you won’t be the only one looking for these indicators. Anecdotally, there are stories of house visits turning into queues of potential buyers. As a result, these desirable properties can go for much higher than the original asking price.

Therefore, it requires plenty of foresight – and a bit of luck – to benefit from these changes.

How can I improve the value of my home?

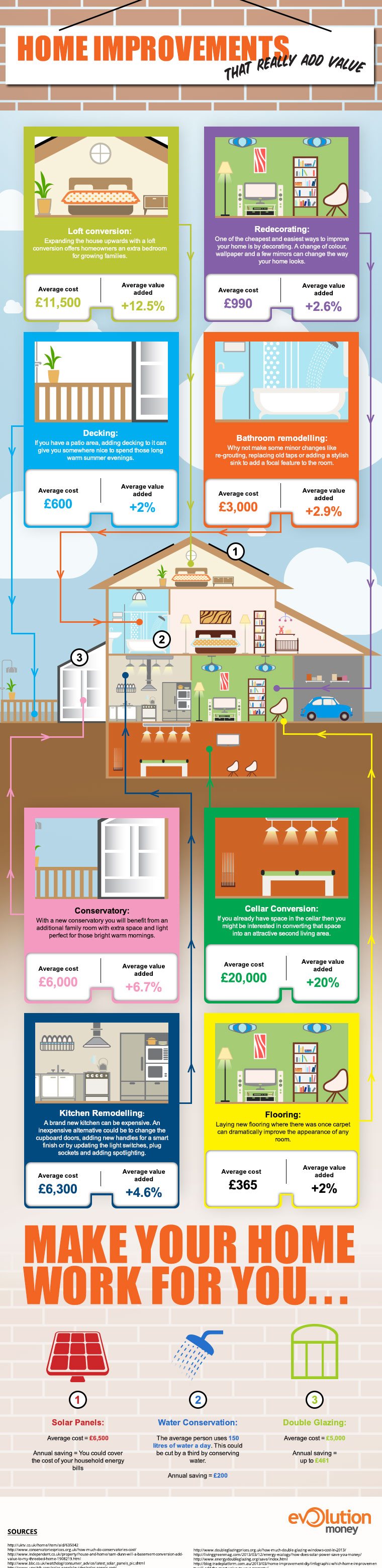

Although location is an area you won’t have much influence over, there are lots of elements you can control. We’ve outlined most of these in our home improvement infographic but we’ve broken down the information here:

How loft conversions affect property values

A loft conversion is a large investment. On average, this can cost around £11,500. However, the benefits could be huge – adding an average 12.5% to the value of a home.

Buyers will always pay more for extra space and a loft conversion is an effective way to do this. However, in some cases, they can be difficult to implement and planning permission might also be required.

Therefore, a survey should be carried out to analyse how feasible this is before taking the plunge.

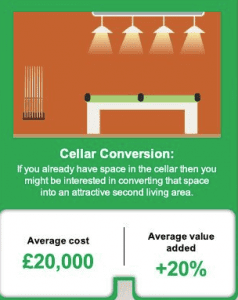

How a cellar conversion can add value to your home

If it’s too difficult to head up, maybe you can head down. If you have a large basement which is being used for storage, you might be able to convert this into an attractive living space. There is a lot of work to making this a viable option though and, on average, can cost around £20,000. However, if successful, a cellar conversion can add an average of 20% to the value of your property.

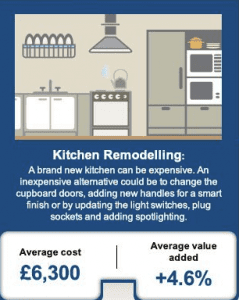

How remodelling the kitchen can increase the value of your property

Installing a brand-new kitchen is often an expensive prospect. However, a kitchen remodel could be a cheaper alternative to increasing property values. For example, changing the cupboard doors and adding new handles can give the place a smarter finish. On average, the cost of a kitchen remodel can come in at around £6,300. Yet, this could add an estimated 4.6 percent to the value of your home.

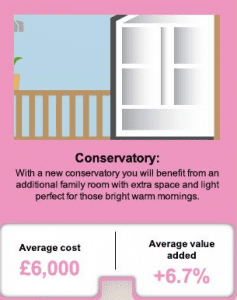

Add a conservatory to increase property value

If you’ve got the space, then a conservatory can be an excellent way to improve the value of your property. However, it is not without challenges. Planning permission might be required and you should decide whether this extension should be east or west-facing. Which direction you choose will determine if the conservatory is better suited as a breakfast room or as an evening living area.

Regardless, for an average cost of £6,000, a conservatory can improve the value of a property by an average of 6.7 percent.

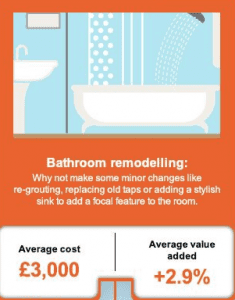

Remodel the bathroom to improve property prices

The bathroom is perhaps the most important room in a home and remodelling it can be greatly beneficial to the overall value of a property. In fact, just keeping it clean and free of grime could be time well spent. Alternatively, remodelling the taps or installing a stylish sink can go a long way to making the bathroom a cheerier place.

On average, remodelling the bathroom can cost around £3,000. However, this could add an average of 2.9 percent to the overall value of your property.

Home improvements for under £1,000

We’ve dealt with some of the larger investments here but there are a variety of smaller jobs which can pay dividends. We’ve detailed some of these suggestions here.

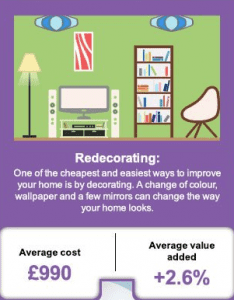

Redecorating and the effects on house values

It’s amazing what a lick of paint can do. However, don’t limit your redecorating to the inside of your home. Sprucing up the outside and tidying up the front lawn can make your property a much more attractive prospect.

Furthermore, if colours are fading, consider replacing them with a new coat of paint or wallpaper. Living areas and bedrooms should feature warm colours, hallways could benefit from neutral schemes, and bathrooms should have cool interiors.

On average, redecorating a home can cost around £990. However, it can add an average of 2.6 percent to the value of your property.

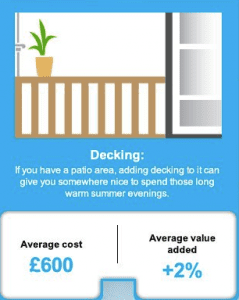

Decking can improve the value of your home

If you already have a patio area then some decking can go a long way to making it a more charming prospect. As long as you use a quality supplier and make the addition an attractive one, you could increase the value of your home as well.

For an average cost of £600, we estimate that the average value of your home could increase by around two percent.

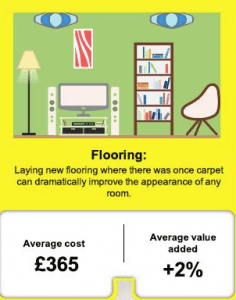

Boost property values by focusing on floors

Replacing carpets with wooden flooring can really make a difference when boosting property values. As long as this isn’t done excessively and uses quality supplies, strong and study wood can enhance the appeal of a room as well as benefit the bottom line.

In fact, spending an average of £365 on flooring could improve the average value of your home by around two percent.

How much value can my property gain?

In this guide we have looked at multiple ways you can improve the value of your home. From larger jobs to quick maintenance, the changes mentioned above should go a long way to affecting your bottom line. If you carried out all of these suggestions, we estimate the price of your home could increase by an average of 53.3% at a cost of around £48,000. Therefore, looking at 2017 average house prices, this means a typical home in the north west could gain around £83,000 in value. In contrast, a standard home in the south east may see its value increase by around £171,000.

Hidden elements which can affect property values

Although there are multiple ways to improve the value of your home, it is worth bearing in mind that there are some hidden factors which can adversely affect a property’s value. For example, these can include:

- Outdated plumbing/problems with water circulation

- Risk of subsidence

- Rude neighbours

- Damp

- Parking facilities

By bearing these in mind when conducting home improvements, we hope you won’t experience any nasty surprises!

Sources

- ‘Waitrose effect’ can ‘boost house prices by thousands of pounds’

- House prices rise 5% a year in more bad news for would-be-buyers

- Five ways to spot an up-and-coming area: The secrets of buying a property ahead of the house price curve

- UK House Price Index (HPI) for July 2017

- So How Much Do Conservatories Actually Cost

- Sam Dunn: ‘Will a basement conversion add value to my three-bed home?’

- How Much Do Double Glazing Windows Cost in 2017?

- The Evolution Money home infographic (see below)

Evolution Money are proud to announce they have won the Feefo Gold Service award for 2018.

This independent award recognises businesses who deliver exceptional experiences rated and reviews from real customers.

Created by Feefo, Trusted service is awarded only to those companies that meet the high standard, based on the number genuine reviews collected and average rating received. This accreditation remains unique, as it is based purely on the interactions with verified customers. All reviews are verified as genuine, the accreditation is a true reflection of a business’ commitment to outstanding service.

Lynne Hardwick Head of Marketing said “It’s a real honour to be recognised for delivering exceptional service for our customers. We’ve been working hard to ensure our customers receive the best possible service. We’re looking forward to another successful year ahead”.

Speaking on this year’s award, Andrew Mabbutt, CEO at Feefo, commented: ‘The Trusted Service award has always been about recognising those companies that go the extra mile. Once again, we have seen many incredible businesses using Feefo to its full potential, to provide truly memorable experiences for their customers – and rightly being awarded with our most prestigious accreditation. I look forward to the continual success of the businesses that work in partnership with Feefo throughout 2018.’

To achieve this coveted Gold Trusted Service 2018 award, Evolution Money collected at least 50 reviews and achieved a Feefo service rating of 4.5 and 5.0. from January to December 2017.

Evolution Money are honoured to be receive this accredited award and are committed to continuing in working hard to deliver outstanding levels of customer service in the future.

Evolution Money, a secured loans provider based in Manchester, has been featured on the Sunday Times Virgin Fast Track 100 league table for the second year in a row.

Published every December, the research highlights those British companies who have achieved the fastest-growing sales within the last three years. Featured for a second time, Evolution Money successfully claimed the 82nd spot as their annual sales increased by more than 52% throughout this period.

Lynne Hardwick – Head of Marketing at Evolution Money – was delighted by the news:

“This is a fantastic achievement and we are extremely proud of all our staff and their continuing efforts. We clearly couldn’t do it without their hard work and support.

“When you consider how many thousands of private businesses there are, appearing anywhere in the top 100 is very special. We are delighted to appear once again in the Sunday Times Virgin FastTrack100.”

The league table is compiled by Fast Track and published in the Sunday Times every year. To qualify, firms must meet a variety of conditions. For example, they must be registered in the UK and have variable sales growth throughout the three-year-period. Of those included in the list, two others were from Manchester – Missguided and CarFinance 247.

Based on Portland Street, Evolution Money is part of Darwin Loan Solutions, and alongside its sister company Progressive Money, employs more than 140 staff members. The firm hopes to continue growing and make it third time in a row during 2018. In the meantime, Evolution Money is planning to celebrate this achievement at their Christmas party.

When Chancellor Philip Hammond announced the first economic budget of his tenure back in March, many people were of the opinion that he was trying to steady the ship wherever possible in the aftermath of Brexit. In which case, any big changes to fiscal policy were to be postponed until later in the year.

Last week saw Hammond unveil many of those changes to the House of Commons as part of his autumn budget. While his focus on increased funding for education – particularly digital skills, computer science and maths – is certainly positive, it’s hard to mask the underlying theme of damage limitation.

For those unfamiliar with GDP targets, the UK’s official economic target is to achieve 2% growth each year. This is actually the first budget in modern record that the Chancellor has forecasted less than 2% growth in any one of the next five years. If there’s any clear signal that the British economy is failing to meet long-term productivity standards, this is it.

How will the budget impact you?

Despite the bigger picture looking slightly bleak for the country as a whole, the majority of taxpayers will find themselves keeping a few extra quid in their pocket at the end of each month. This is due to the personal allowance increase of £350 – up to £11,850 – which will come into effect in April 2018.

As for pensioners and other non-tax payers, the net increase will be lower, although they do stand to gain an extra £8 per month following the changes. This is with the exception of some married pensioners, who stand to gain as much as £57 per month. However, it’s worth bearing in mind that these increases must also be weighed up against inflation and rising prices for household goods.

As always, housing also remains one of the country’s main concerns. Chancellor Hammond addressed the issue head-on, explaining that not enough homes are being built but that there is no simple, short-term solution to the problem. Instead, long-term changes to planning regulations, construction legislation and policies at local council level are needed.

It looks like we may have a challenging few years ahead.

Winter has arrived, which means we’re closing in on that special time of year when households up and down the country start thinking about whether or not to turn the heating on.

A warm, cosy house is an inviting prospect for all of us, of course, so you may be pleased to hear that it doesn’t necessarily need to result in weighty heating bills. Homeowners are constantly told to consider double glazing, or a heating system overhaul; but are there any quicker, less expensive ways to keep your monthly heating bills in check?

We’re here to run you through a few tips and tricks that could help to cut the cost of staying warm over the coming months – let’s dive straight in.

Review your insulation

A solid first port of call for any homeowner is to review their quality of insulation, particularly in the attic and cavity walls. People often do this manually by gaining access to the insulation through a small hole, or entry point, in an interior wall to check what has already been fitted.

Alternatively, many energy companies are happy to arrange an official review that will confirm what type of insulation is installed, and whether it is sufficient to prevent rapid heat loss. When fitted correctly, a comprehensive approach to insulation can shave hundreds off an annual energy bill.

Check for draughts

Beyond wall insulation, doors and windows play a huge role in any property’s ability to retain heat, so it makes sense to review any air leaks that may be causing cold around your house – before patching them up.

Start with a detailed inspection of each room. If you find that the border or stripping of a particular door or window is not sufficiently sealed then you’re likely to be losing valuable heat. A single threshold that isn’t properly insulated may not seem like much, but when more than one gap is left unchecked, that’s when you start feeling the draughts.

Localise the warmth

Many people are quick to switch on the heating for an entire house, even if they only need to heat a single room or space. Rather than relying solely on the boiler, you might be able to save a few quid by investing in a portable heater and putting it to use where necessary.

Sure, the remaining rooms in the house might be a little bit cooler, but the overall saving on gas often outweighs the additional electricity usage. Decent heaters tend to start at around £30 but the savings from the boiler should offset this cost and then some, particularly in the long run.

Invest in thicker curtains

While you may be committed to a particular colour scheme in your living room or bedroom, it’s always a good idea to have a backup pair of curtains ready to go when the temperatures start to drop.

This is especially the case if a house does not have double glazing installed throughout. In this case, a pair of curtains with a thick thermal lining is essential for those who want to retain as much internal heat as possible.

Shop around for a better rate

It’s no real surprise that the total price of our gas and electric bills tends to come to the fore of our minds during the winter months. This is usually the time when homeowners start thinking about the best possible deal they can get on their utilities.

There are plenty of comparison websites out there through which people can check how much, if anything, they are in line to save by switching. But before changing providers, it’s important to bear in mind that there may be certain cancellation fees for exiting out of a fixed rate tariff early.

Recently, the Bank of England made the decision to raise interest rates for the first time in ten year – an increase back to 0.5% from the historic low rate of 0.25%. This marks a signal of intent from the BoE’s monetary policy committee and ultimately means that the cost of borrowing is on the up.

So how exactly will this affect the average UK household? First of all, standard procedure will see this change in the base interest rate reflected on the high street, with most retail banks increasing their mortgage rate by 0.25% in line with the BoE.

For those people who are currently on a variable or tracker mortgage, this will see their monthly expenditure rise in the run-up towards Christmas. According to recent stats from Nationwide, this amounts to around 5 million British people, which works out to just under half of all mortgage owners across the country. It’s also worth remembering that the increase comes at a time when most homeowners are experiencing a freeze in their earnings, which will ultimately mean less disposable income to spend at the end of each month.

As you’d probably expect, the Bank of England’s decision has provoked plenty of reaction from economists and social commentators. Some experts say that, although there will be an expected dip in demand within the housing market, this suggests a fledgling indication of greater confidence in the economy that could have a positive impact in the longer term.

In fact, it’s perhaps our best indication in over a decade that the air of caution surrounding the economy since the credit crunch is beginning to turn around. Speaking to journalists off the back of the announcement, Governor of the BoE Mark Carney explained that the country was perfectly placed to handle the increase:

“To be clear, even after today’s rate increase, monetary policy will provide significant support to jobs and activity. And the Monetary Policy Committee continues to expect that any future increases in interest rates would be at a gradual pace and to a limited extent.

“Fully 60% of mortgages are now at fixed interest rates. Even with this Bank Rate increase, many households will refinance onto lower interest rates than they are currently paying by around 30 basis points for those moving from an expiring two-year fixed rate deal to around two percentage points for someone refinancing an expiring five-year fixed rates deal.”

If you’re still looking to clarify how your own mortgage may be affected by the interest rate increase, we recommend getting in touch with your local bank or building society.

Halloween season is upon us once more, and what better way to celebrate than throwing a little shindig (preferably fancy dress) with your nearest and dearest.

One thing’s for certain: you certainly won’t be alone in the celebrations. A survey from consumer experts Mintel last year found that British people spend a whopping £33 million per year on Halloween goodies, costumes and party props. And while this total spending may pale in comparison to our American cousins across the pond, it’s still enough to send shivers down the spine of your wallet.

With this in mind, we’re here to pull together a few useful Halloween party ideas and details that could really flip the switch on any Halloween party. In fact, we’d say you don’t need to spend a whole lot of money at all, so long as you’re thinking creatively about how to give folks a frightful evening they won’t soon forget.

Let’s dive straight in, shall we?

The budget costume

While any old Tom, Dick or Harry can nip down to their local fancy dress shop and pick out a pre-packaged Zorro outfit complete with hat, sword, eye mask and all the trimmings… we’d say that’s taking the easy way out.

Perhaps a more challenging (and fun!) approach is to put the kettle on and write a shortlist of memorable people, icons or characters that you can recreate with items you already have. This could even help establish a particular theme for the party. For instance, if you like glam-rock and happen to have some blue eye-shadow hanging around then you’re already well on your way to an awesome Ziggy Stardust costume.

Just remember, the devil really is in the detail.

The food and drink selection

Ah yes, what fine Halloween bash would be complete without a comfortable provision of cool things to nibble and cold things to sip? For those looking to inspire a little spookiness among their guests, here’s another perfect opportunity to get creative.

If it’s a classier affair, a pumpkin cheesecake or ‘spider web’ cake always go down a treat – and they’re not too difficult to make. Or, if you wanted to go a little bit more gross with it, you could even get yourself a cheap mould and make a few helpings of ‘brain jelly’, perhaps even stirring in a few glugs of your preferred liqueur. The choice is yours.

Decorations

Of course, you might also be looking for ways to transform your house into a den of evil; for one night, at least. One of our favourite tricks to paint an old egg carton black and give each one a pair of stick on eyes. When hung upside-down from a lamp shade, you’ve got yourself a makeshift bat colony.

Lighting is also important here, and you can create an unusual ambience in a few ways. A well-cut jack-o’-lantern is an obvious purchase for most parties, though you can take this to the next level by dotting a few more around the rooms in which you are entertaining. Perhaps each one with a different facial expression. Or, if you have a neon theme going, replace your standard light bulb with a UV version for a chillingly strange effect.

Anyway, if you’re thinking about throwing a Halloween party of your own then we hope this list has inspired you to think a little bit more outside the coffin. Good luck and happy spooking.

There’s been a lot of talk over the past few years regarding Britain’s so-called ‘gig economy’, particularly the growing number of zero-hours contracts in the job market. In a nutshell, these are contracts that do not guarantee a minimum number of hours per week. But while some say this structure of working affords people greater flexibility and control over their work-life balance, many people argue it can easily lead to a basic breach of employment rights.

Whichever way you look at it, recent findings from the Office of National Statistics (ONS) show that the number of people currently on zero-hours contracts has fallen by 2.2% compared to this time last year. This also means that the number of zero-hours contracts is now at its lowest point in the past three years, a sign that the trend may be beginning to slow down.

It tends to be larger established businesses and corporations that are among the main proponents of zero-hours contracts, particularly those in the admin support, delivery and food services industries.

Under investigation

Following calls from workers and union officials, Theresa May ordered a national inquiry into modern working practices, including the widespread usage of zero-hours contracts, earlier this year.

The subsequent report delivered by Matthew Taylor back in July found that zero-hours contracts had contributed greatly to record levels of employment in the UK. And although Taylor made the point that around 68% of those on these contracts did not want more hours, he also argued that employers and businesses were relying too heavily on short-hours contracts in their scheduling, as well as stating that all zero-hours workers should have the right to request a fixed number of working hours contract should they wish to.

Although any prospect of a national strategy to protect the rights of zero-hours workers remains in its infancy, the feeling is there that the Government is starting to better define the parameters for businesses and workers alike. And, judging by the recent drop in these contracts, it may very well be that the casual working boom has reached its peak.

Representative 28.96% APRC (Variable)

For a typical loan of £26,600 over 180 months with a variable interest rate of 19.56% per annum, your monthly repayments would be £484.00. This includes a Product Fee of £2,660.00 (10% of the loan amount) and a Lending Fee* of £763.00, bringing the total repayable amount to £87,030.00. Annual Interest Rates range between 11.7% to 46.5% (variable). Maximum 50.00% APRC. *Lending Fee varies by country: England & Wales £763, Scotland £1,051, Northern Ireland: £1,736.

Think carefully before securing debts against your home may be repossessed if you do not keep up repayments on your mortgage or any other loan secured against it. If you are thinking of consolidating existing borrowing, you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.