The average house buyer in the UK now requires six times the amount of their yearly income to secure a home, according to latest official figures from the Office of National Statistics (ONS).

This confirms that house prices have risen at a far quicker rate than average earnings over the past decade. In fact, the ONS found that house prices have risen by as much as 88% – from £110,000 in 2002, to £207,500 in 2015. Compare that to average earnings increase during the same period – £26,000 in 2002, to £32,780 in 2015.

It’s easy to see the disparity between these two sets of growth, but it’s also worth bearing in mind the two ends of this spectrum because the average figures alone don’t quite tell the whole story.

The most and least affordable places to live in the UK

The ONS data actually showed that in a third of local authorities across the country, house prices had actually reached more than 10 times salary earnings, with the biggest gaps unsurprisingly found in London and the south-east.

Regional differences show that Burnley is the most affordable place to live in the UK; whereas Westminster ranks as the least affordable. The median house price in Burnley is a mere 3.6 times the median salary, compared to 23 times the median salary in Westminster.

The ONS report is perhaps our most recent evidence that the North/South divide is still very much in effect in the housing market.

Tough times for all buyers, not just first-timers

The theme of first-time buyers struggling to secure their first step on the property ladder is well-known. It’s now becoming more and more obvious that homeowners and renters across the country are losing a bigger slice of their income to the cost of accommodation, particularly those on the move.

And although there has been some movement from the government to increase housing provision throughout the country, many experts maintain that the UK is still far off the number of houses needed to make housing as affordable as it was ten years ago.

It’s 1966. Families nationwide crowd around tiny television sets to watch Bobby Moore lift the World Cup for England at Wembley.

James Callaghan, Chancellor of the Exchequer, declares his intention to shift to decimalisation of the pound in five years’ time. Beatlemania is in full swing, and the song ‘Taxman’ on their latest album Revolver complains of high marginal rates of up to 95%.

British MPs debate the prospect of joining the European Union (then known as the European Economic Committee), approximately 50 years before debating an eventual exit.

Personal finances were also remarkably different compared with those of today. The average weekly wage, usually paid in cash on a Friday, was between £20–£27 whilst the average house price was around £3,620. It was a different world, financially and otherwise.

Changing attitudes and added complication

The way people approached their weekly budget was remarkably different, particularly the propensity to save which was far greater than today’s standards. Back in 1966, common practice was to keep a weekly or monthly ledger that showed exactly how much spending was going out against your total income.

The concept of being able to check a bank statement in the palm of your hand was inconceivable. And in a world without ATMs and online banking, a ledger was absolutely essential to tot up your total outgoings. In many ways this made the general public of 50 years ago far more frugal with their spending.

Now that we have the ability to check our bank balance at a moment’s notice, the need to meticulously run through your family budget each week, or even withdraw a precise amount of money for the week ahead, has certainly lessened.

Tending more to spend

On the whole, today’s generation have become more cavalier with their weekly expenditure. This uplift in spending is also due to the massive development of products and services that we’ve experienced in the latter 20th century. Thousands of new household ‘essentials’ have been introduced to the masses in that time – colour TV, fridge freezers, vacuum cleaners, broadband, the list goes on.

Saving has given way to spending because we have so many more options and incentives to consider, coupled with our ability to pay for anything with a piece of plastic. Personal finance was a different ball game back in 1966, and perhaps we can even learn something from the way things used to be.

Evolution Money is a non-LTV lender offering secured loans from £1,000 – £20,000 to clients with zero or restricted equity and mortgage arrears. Read more about our loan service and how we can help you today.

Times are getting tougher for first-time buyers looking to secure a high-value mortgage and get their first foot on the property ladder.

That’s because the total number of high-value mortgages has fallen for two consecutive months between July and September. It effectively means that mortgages which require a minimum deposit of 5% are currently fewer than they have been at any other point of 2016.

In fact, high-value loans with 5pc deposits now account for just 2.5pc of overall lending, which is quite a drop considering that figure stood at 4.2pc in the second quarter of 2014.

Mapping the mortgage landscape

But while the availability of high-value mortgages has shrunk, it is also worth noting that they are the only type of mortgage to do so. Elsewhere in the market, the number of mortgages that require a larger deposit amount (anything from 10pc) has actually steadily risen since January.

Experts within the housing market consider it to be another side effect of the Brexit vote, whereby lender appetite to take on the greater risk of a 5pc deposit has naturally declined in a time of economic uncertainty. It is this lack of appetite that seems to be preventing first-time buyers from staking their first claim in the housing market.

It is also thought that the drop in first-time buyers will have a further knock-on effect by preventing established homeowners from moving further up the property ladder.

Evolution Money is a non-LTV lender offering secured loans from £1,000 – £20,000 to clients with zero or restricted equity and mortgage arrears. Read more about our loan service and how we can help you today.

Last month, the Bank of England (BoE) lowered interest rates from 0.5% to 0.25%, a record low and the first cut since 2009. Mark Carney, Governor of the Bank of England, explained that the decision is a pre-emptive measure for the sluggish economic growth forecasted over the next few years.

This forecast is largely due to the inevitable “regime change” that’s expected following the UK’s exit from the EU earlier this year. Until policymakers successfully define a new relationship with EU countries – particularly on the movement of goods, services, people and capital – the future of the economy is open to debate.

Lower interest rates explained

Simply put, a cut in interest rates aims to get people spending. The overall cost of borrowing for both commercial banks and the general public is less, which encourages both people and businesses to save less and invest more.

For homeowners it could mean lower mortgage repayments – some predict as much as £22 a month cut in their average monthly bill – depending on their type of mortgage. This affords homeowners more disposable income which should give them more confidence to spend.

For savers, a cut in interest rates is generally considered bad news because they will see a worsened rate of return on their savings. The demographics that tend to be more keen to save, such as pensioners, are those most likely to be affected by the cut.

A short-term hiccup?

Given the BoE’s recent forecast for diminishing growth, many people are asking whether the short-term impact of Brexit will lead to another UK recession – defined as two consecutive negative quarters of economic growth.

Carney and other leading economic advisors say this is unlikely, and remain optimistic that the post-Brexit shock we’ve seen in the previous quarter will soon give way to a return in confidence.

The decision to cut interest rates to 0.25% is effectively a way to spur this process along a little faster. There’s even scope for the Bank Rate to drop even further, to 0%, by the turn of next year.

Evolution Money is a non-LTV lender offering secured loans from £1,000 – £20,000 to clients with zero or restricted equity and mortgage arrears. Read more about our loan service and how we can help you today.

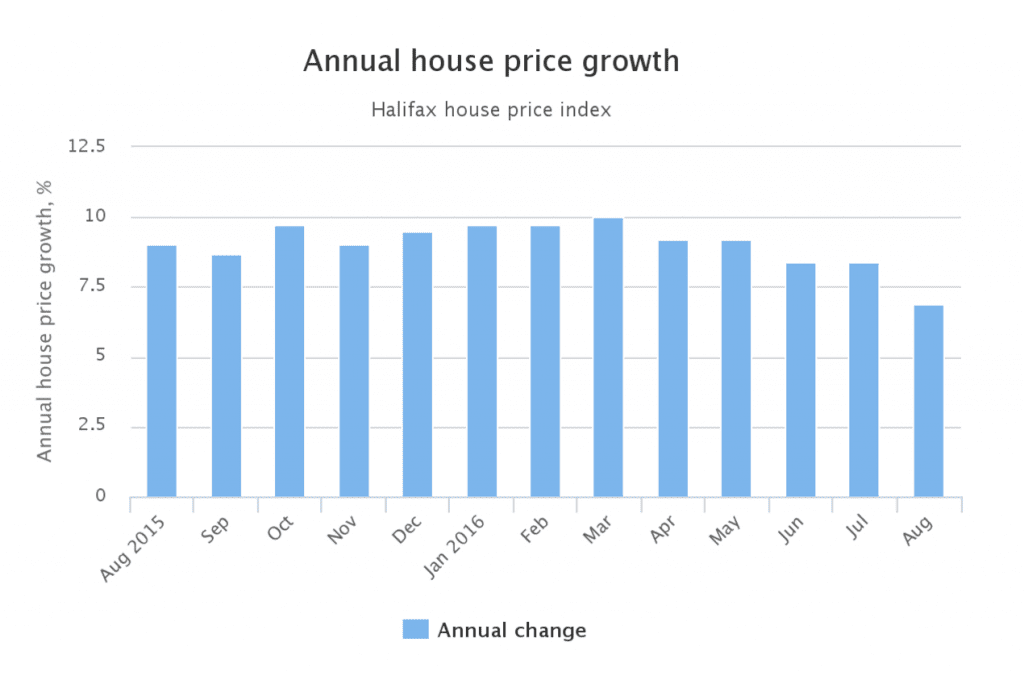

House prices in the UK have continued to follow the trend of recent months, falling in August by 0.2% overall. This follows a sizable drop in July of 1.1%, which means that the average UK house price now sits at £213,930.

The figures, released by banking giant Halifax, clearly show that activity in the housing market has dropped off since the early months of the year. This news follows a survey by the Royal Institution of Chartered Surveyors (Rics) last month that revealed a record low number of homes listed on the market, and the lowest quarterly growth since December 2014.

The post-Brexit factor

Confidence in the housing market was widely expected to wane following the Brexit referendum, with many buyers and sellers deterred from entering the market altogether.

This, coupled with increasing prices in the early months of 2016, has caused the drop off in sales that we are now seeing. And as both demand and supply for houses drops, so does the average market price.

The below chart shows the decrease in annual house price growth between June and August:

The impact for house buyers and sellers

If you’re considering buying a house as the market reaches a ‘low point’ be mindful that, although you may be more likely to find a bargain, your options are bound to be far more limited than at other points in the year.

On the other hand, homeowners looking to sell are likely to prefer to wait until the market price picks up before listing their property on the market.

Always remember to take seasonality into account. As a rule of thumb, spring is usually the most active month for buyers and sellers in the housing market; whereas summer and winter are comparatively quiet.

A downturn during July and August isn’t all that surprising during the ‘holiday’ months, and we’d expect the appetite for buying homes to pick up for a month or two as we enter autumn. The revived demand in September and October tends to be caused by buyers who are in a rush to move into a new home prior to the festive season. However, there tends to be very little activity between October and January.

The longer term forecast

Despite the current downturn, housing experts say that confidence in the housing market will gradually return following the initial post-Brexit shock. Some also maintain that a long term increase in prices is on the horizon – a 3.3% increase over the next five years according to Rics.

Evolution Money is a non-LTV lender offering secured loans from £1,000 – £20,000 to clients with zero or restricted equity and mortgage arrears. Read more about our loan service and how we can help you today.

Evolution Money are celebrating today after successfully being named, for an impressive second year running, Best Second Charge Mortgage Lender in this year’s coveted Financial Reporter Awards 2016

Rhian Roberts, Head of Evolution Money Broker Division commented:

“Another outstanding accolade for the Evolution Money team, along with recently becoming fully authorised by the FCA, 2016 has started on a very positive footing and this award further establishes our position in the market. Thanks again to all our partners who voted”

The awards honors industry leaders, and professional movers and shakers from across the lending arena, while recognising the respect and esteem Evolution Money has within the sector. Votes are gathered from industry peers and professionals directly, and not a panel of judges.

After five years, Evolution Money continues to stand-out as a market leader. Receiving full authorisation from the FCA in March, having a talented, experienced Business Development team in place and launching a brand new corporate customer focused website, illustrates the company’s ongoing success and strength as a key player in the second charge sector. In addition, providing a great end-to-end customer journey is paramount to the company’s ethos and respected business approach.

The winners’ presentation ceremony will take place on 17th May 2016, at Manchester Museum of Science & Industry. Attended by this year’s victors, runner-ups and industry professionals, the event should prove to be a celebratory affair.

For a full list of all the winners please go to www.financialreporter.co.uk/awards/winners-2016/

If you would like more information about this topic, Evolution Money Limited, please contact Nicola Pilling on 0161 814 8918 or email at [email protected].

Manchester based lending specialist Darwin Loan Solutions, has today announced, all of the companies within the group have received their own full authorisation from the FCA.

Evolution Lending, Evolution Money and Progressive Money are delighted that full authorisation was received in such a short time, and expressed thanks to all their staff and colleagues who worked together in achieving this, along with demonstrating the organisational values that support great consumer outcomes.

The announcement follows the implementation of MCD this week, and recognises that providing a great end-to-end customer journey is paramount across the company’s ethos and respected business approach.

Mat Beaver, Managing Director commented;

“We understand authorisation is just the start of an ongoing expectation and we are committed to the development of all staff within the business in order to support a great culture and achieve regulatory conformance. Therefore a significant percentage of customer facing staff are already on their way to CeMap qualification, well-ahead of the required deadline”.

The group continues to be innovative industry leaders by providing niche secured and unsecured loan products to its customers, further cementing its commitment to continued growth, product delivery and customer satisfaction.

If you would like more information about this topic, Darwin Loan Solution Limited or Evolution Money Limited, please contact Nicola Pilling at 0161 814 8918 or email at [email protected].

First time buyers in some parts of the country will have to save for at least ten years if they are to afford the deposit for a home. Single people and those with young families find it particularly hard, says Shelter, the housing charity.

The high cost of living, static wages and rising house prices mean that childless couples must save for six and a half years in order to accumulate a 20 per cent deposit for their first home in England, and single people, 13 years. Even though wages are generally higher in the south east and in London, so too are rents, which means that it takes first time buyers longer to build sufficient funds for a deposit.

According to new research by Shelter, a couple living in London with a joint income of £53,384 will take 13 and a half years to save for a deposit on a home. Couples living in Windsor, Brighton, Maidenhead, Devon, Surrey and Oxfordshire will also have to save for more than ten years.

Couples with young children face an even longer struggle. Shelter says that when one parent works part-time, it takes 12 years to save enough for a deposit in England. For young families living in London, it would take 26 years. Single Londoners might find themselves saving for 29 years, to be able to afford a 20 per cent deposit.

The research for Shelter was undertaken by Liverpool Economics, which took into account house prices, wages and rents. Shelter’s CEO, Campbell Robb, said that home ownership is no longer affordable for many first time buyers and is now just a fantasy.

Buyers who succeed in raising a deposit of 20 per cent will find it easier to get mortgages at lower rates of interest. However, many mortgage companies do offer mortgages for buyers who can raise only a 5 per cent deposit.

Deciding which type of loan is the best depends entirely on your own circumstances as neither of these loan options is the best choice every time.

Secured loans are usually secured against a property; these loans are more attractive to those who are finding it difficult to borrow the amount they need through an unsecured loan. Secured loans could be a more viable option for those who have poor credit, need more money or who want to borrow over a longer period of time. Unsecured loans are becoming harder to get, and are only really suitable to those with good credit ratings to ensure a lower interest rate.

Use the below comparison table as a guide only for differences between the two loan types:

| Secured Loan | Unsecured Loan | |

| Can I get a get a loan with a poor credit history? | Yes | Yes |

| Can I borrow a large amount (i.e. £15,000)? | Yes | Yes |

| Can I make payments over a longer period of time (i.e. 10 yrs)? | Yes | No |

| Can I get a loan without owning an asset? | No | Yes |

| Is the loan cheaper than using payday loans and store cards? | Yes | Yes |

| Do you offer the lowest interest rate? * | Yes | No |

| If I can’t repay my loan is my home at risk? | Yes | No |

If you are not a homeowner then a secured loan through Evolution Money would not be an available option for you. In which case, if you desire a loan then you will need to have a good credit rating to ensure that you are offered a favourable interest rate with an unsecured loan lender.

If a secured loan sounds like an option for you or to find out more about getting a secured loan through Evolution Money. If you would like to see how affordable a secured loan is why not try our handy loan calculator?

* Interest rates are usually determined by the loan amount, loan term and ability to repay. Unsecured loans typically carry a higher interest rates than secured loans as the lender will be wary that the loan being lent is not secured against any assets should you default on the loan.

Home improvements can scale from a complete demolition of walls and extreme renovation, to the smaller less demanding task of redecorating the spare bedroom. Whatever level of improvements you want to make around your home rest assured that a home improvement loan through Evolution Money can help.

Here are just some of the ways our home improvement loans have helped our customers:

New Bathroom

Improving the bathroom is one of the easiest ways to improve your home. Bathrooms can quickly look outdated and a major bathroom re-fit can cost into the thousands of pounds. Nevertheless, if you want to update the current look and feel then a new stylish bathroom suite could be found for as little as £400.

New Kitchen

The kitchen is the heart of the home and often plays an integral part in the valuation the house. So, whether you are looking to make large changes and invest in some new cupboard units, appliances and work surfaces or you just want to spruce the kitchen up with some new fancy taps, cupboard handles and plug sockets. A home improvement loan through Evolution Money can give you the help you need to get the work started.

Going green

If you’re interested in ‘going green’ and making savings on your water and energy bills then a home improvement loan could be right for you. Our loans are used for various sustainable initiatives – whether you’re wanting to install solar panels to your roof, double glazed windows or just looking for ways to conserve the water you use, Evolution Money can help.

Adding a Conservatory

Conservatories are well sought after as they can well extend your summer living into the winter months. Obviously not all houses can accommodate a conservatory, but those that can offer themselves a great opportunity to get the most from their homes. However be sure to shop around for quotes and design options before making your decision.

Converting the loft

Choosing to expand the home upwards with a loft conversion offers homeowners an extra bedroom for growing families and can be a great return on your investment in the long run. Not all homes can accommodate a loft conversion, but if you’ve got the space it can be a great way to add extra value to your home.

Open plan

For many people the idea of an open plan home offers living arrangements a sense of space and light. Obviously you’ll need to seek professional advice before you undertake a project of this magnitude and start knocking walls down.

Have a look at our home improvement infographic on other ways to add value to your home, make savings and even how it could make you money. With loans available from £1,000 to £20,000 getting a Home Improvement loan whatever your plans has never been more appealing. Why not see how affordable our loans are with our handy loan calculator.

Representative 28.96% APRC (Variable)

For a typical loan of £26,600 over 180 months with a variable interest rate of 19.56% per annum, your monthly repayments would be £484.00. This includes a Product Fee of £2,660.00 (10% of the loan amount) and a Lending Fee* of £763.00, bringing the total repayable amount to £87,030.00. Annual Interest Rates range between 11.7% to 46.5% (variable). Maximum 50.00% APRC. *Lending Fee varies by country: England & Wales £763, Scotland £1,051, Northern Ireland: £1,736.

Think carefully before securing debts against your home may be repossessed if you do not keep up repayments on your mortgage or any other loan secured against it. If you are thinking of consolidating existing borrowing, you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.