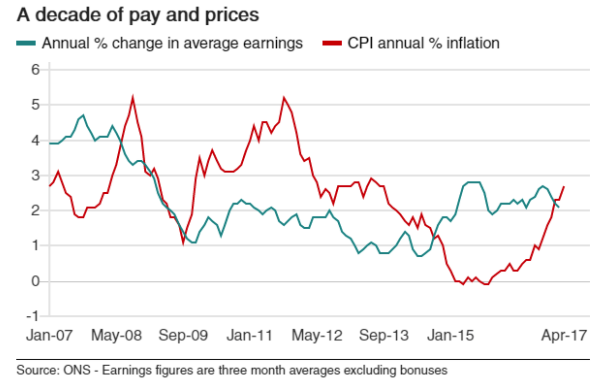

A recent national report conducted by the Office of National Statistics (ONS) has revealed that wages are increasing at a slower rate than inflation for the first time since 2014. Right now, the average salary has increased by 2.1% in the three months to March; however, inflation is up 2.3% over the same time period, creating a differential of -0.2%.

Simply put, the average cost of living is currently rising at a faster rate than real wages, which means that people now have less disposable income after paying for their weekly and monthly essentials. Experts say that the current trend can be attributed to the longer term impact of Brexit on UK households and their total budget.

The below graph is a good visualisation of the current trend, and shows the correlation between average earnings and inflation (CPI) over the last 10 years:

Unemployment lower than ever – but is it all good news?

Also this week, the ONS announced findings that the UK unemployment rate was the lowest it’s been for 42 years. Currently, there are approximately 31.95 million people in work, which works out to around 75% of 16 to 64-year olds.

It’s clear that Britain’s businesses are now hiring more employees than at any other point in recent memory; the problem is that the average job cannot be considered ‘well-paid’ in the context of our current cost of living. Again, the general thought among economists is that this trend is only temporary, and it won’t be long before real wages start rising in line with the demand for employment.

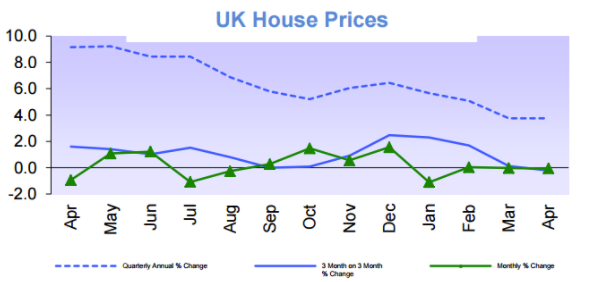

According to a recent statement released by Halifax, house prices in the three months to April 2017 were approximately 0.2% lower than in the previous quarter. That means the average house price now stands at £219,649. Although the fall may seem marginal enough, this is actually the first quarterly decline in the UK housing price index since November 2012.

The report follows another statement made by Nationwide last week that revealed house prices were, in fact, growing at a slower annual rate than at any other time during the last four years – a relatively sluggish 2.6% growth per year, to be exact.

Both reports are indicative of a general downward trend emerging in the property market in the first half of 2017:

Why are house prices stagnating?

The fall in house prices reflects the current demand for housing, which seems to have been falling in recent months due to affordability.

If you consider that until this point house prices have been consistently inflating each quarter for nearly five years, it seems that now we’ve finally reached a tipping point – albeit a modest one. Simply put, the cost of reaching the next rung on the property ladder has inflated beyond what most people can afford.

Supply is also a major factor. A recent RICS report revealed that the average stock levels on estate agents’ books is at a historic low, which means there are fewer options than ever for people looking to move.

Nevertheless, mortgage rates remain very low which, coupled with a general shortage of supply across the country, is expected to keep the housing market at a steady level over the next quarter.

The 16th of May is a very special day on the Evolution Money Calendar – it’s our birthday!

So, this time 6 years ago what was happening…? Well, our colleague James was sitting at his desk (as he is today) but back then he was very excited at the thought of us funding our very first loan, a loan for £750.

It was Monday 16th May 2011 and the business was packaging its very first loan. We had been preparing for this moment for five months and the tension was building… we packaged it, approved it and prepared it for a pre-funding review.

The file was passed to our FD who scrutinised it to within an inch of its life, before he counter-signed it and we were ready to go…

At 16:44 on Monday 16th May 2011 we hit the button and the funds were transferred and that was it, our first loan was funded and Evolution’s journey had begun…!

Fast forward 6 years and what does the business look like today?

Well, we are now a multi award winning, multi-million-pound business…

We’ve outgrown the stationery cupboard we started out in and now employ over 150 people. From that first loan for £750 we have gone on to lend a staggering £134m to over 14,000 customers. That’s certainly something worth celebrating.

One of the highlights of the last six years must be watching how people have grown with the business and seeing new people join. At Evolution Money, we truly do have a brilliant team of people. It’s testament to the business that many of the original team are still here all this time later.

Six years on, as MD, I am still as excited as I was when we funded that first loan. The building blocks have been secured for the future and the business continues to grow from strength to strength.

The future is still for us all to determine and if we work together it will be great. We must remember the founding value of our business, succinctly rolled up in one word – TRUST.

Trust that we are doing the right things every day. Trust from our investors that we are running a compliant and robust business. Trust from our customers that we interact with them in a fair and transparent way, ensuring they are at the heart of everything we do. Trust from our colleagues that we are all working together and that no one individual is more important than the team…. If we achieve this then we will continue to have a great business.

On behalf of myself and the rest of the Directors a huge THANK YOU to both our customers and our team for the journey so far and we look forward to working with you for the next 6 years…

Mat Beaver,

Managing Director

Representative 21.54% APRC (Variable)

For a typical loan of £12,000 over 60 months with a variable interest rate of 21.54% per annum, your monthly repayments would be £310.60. This includes a Product Fee of £1,200.00 (10% of the loan amount) and a Lending Fee* of £763.00, bringing the total repayable amount to £18,635.80. Annual Interest Rates range between 8.6% to 27.87% (variable). Maximum 50.00% APRC. *Lending Fee varies by country: England & Wales £763, Scotland £1,051, Northern Ireland: £1,736.

Think carefully before securing debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage or any other loan secured against it. If you are thinking of consolidating existing borrowing, you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.