It’s 1966. Families nationwide crowd around tiny television sets to watch Bobby Moore lift the World Cup for England at Wembley.

James Callaghan, Chancellor of the Exchequer, declares his intention to shift to decimalisation of the pound in five years’ time. Beatlemania is in full swing, and the song ‘Taxman’ on their latest album Revolver complains of high marginal rates of up to 95%.

British MPs debate the prospect of joining the European Union (then known as the European Economic Committee), approximately 50 years before debating an eventual exit.

Personal finances were also remarkably different compared with those of today. The average weekly wage, usually paid in cash on a Friday, was between £20–£27 whilst the average house price was around £3,620. It was a different world, financially and otherwise.

Changing attitudes and added complication

The way people approached their weekly budget was remarkably different, particularly the propensity to save which was far greater than today’s standards. Back in 1966, common practice was to keep a weekly or monthly ledger that showed exactly how much spending was going out against your total income.

The concept of being able to check a bank statement in the palm of your hand was inconceivable. And in a world without ATMs and online banking, a ledger was absolutely essential to tot up your total outgoings. In many ways this made the general public of 50 years ago far more frugal with their spending.

Now that we have the ability to check our bank balance at a moment’s notice, the need to meticulously run through your family budget each week, or even withdraw a precise amount of money for the week ahead, has certainly lessened.

Tending more to spend

On the whole, today’s generation have become more cavalier with their weekly expenditure. This uplift in spending is also due to the massive development of products and services that we’ve experienced in the latter 20th century. Thousands of new household ‘essentials’ have been introduced to the masses in that time – colour TV, fridge freezers, vacuum cleaners, broadband, the list goes on.

Saving has given way to spending because we have so many more options and incentives to consider, coupled with our ability to pay for anything with a piece of plastic. Personal finance was a different ball game back in 1966, and perhaps we can even learn something from the way things used to be.

Evolution Money is a non-LTV lender offering secured loans from £1,000 – £20,000 to clients with zero or restricted equity and mortgage arrears. Read more about our loan service and how we can help you today.

Times are getting tougher for first-time buyers looking to secure a high-value mortgage and get their first foot on the property ladder.

That’s because the total number of high-value mortgages has fallen for two consecutive months between July and September. It effectively means that mortgages which require a minimum deposit of 5% are currently fewer than they have been at any other point of 2016.

In fact, high-value loans with 5pc deposits now account for just 2.5pc of overall lending, which is quite a drop considering that figure stood at 4.2pc in the second quarter of 2014.

Mapping the mortgage landscape

But while the availability of high-value mortgages has shrunk, it is also worth noting that they are the only type of mortgage to do so. Elsewhere in the market, the number of mortgages that require a larger deposit amount (anything from 10pc) has actually steadily risen since January.

Experts within the housing market consider it to be another side effect of the Brexit vote, whereby lender appetite to take on the greater risk of a 5pc deposit has naturally declined in a time of economic uncertainty. It is this lack of appetite that seems to be preventing first-time buyers from staking their first claim in the housing market.

It is also thought that the drop in first-time buyers will have a further knock-on effect by preventing established homeowners from moving further up the property ladder.

Evolution Money is a non-LTV lender offering secured loans from £1,000 – £20,000 to clients with zero or restricted equity and mortgage arrears. Read more about our loan service and how we can help you today.

Last month, the Bank of England (BoE) lowered interest rates from 0.5% to 0.25%, a record low and the first cut since 2009. Mark Carney, Governor of the Bank of England, explained that the decision is a pre-emptive measure for the sluggish economic growth forecasted over the next few years.

This forecast is largely due to the inevitable “regime change” that’s expected following the UK’s exit from the EU earlier this year. Until policymakers successfully define a new relationship with EU countries – particularly on the movement of goods, services, people and capital – the future of the economy is open to debate.

Lower interest rates explained

Simply put, a cut in interest rates aims to get people spending. The overall cost of borrowing for both commercial banks and the general public is less, which encourages both people and businesses to save less and invest more.

For homeowners it could mean lower mortgage repayments – some predict as much as £22 a month cut in their average monthly bill – depending on their type of mortgage. This affords homeowners more disposable income which should give them more confidence to spend.

For savers, a cut in interest rates is generally considered bad news because they will see a worsened rate of return on their savings. The demographics that tend to be more keen to save, such as pensioners, are those most likely to be affected by the cut.

A short-term hiccup?

Given the BoE’s recent forecast for diminishing growth, many people are asking whether the short-term impact of Brexit will lead to another UK recession – defined as two consecutive negative quarters of economic growth.

Carney and other leading economic advisors say this is unlikely, and remain optimistic that the post-Brexit shock we’ve seen in the previous quarter will soon give way to a return in confidence.

The decision to cut interest rates to 0.25% is effectively a way to spur this process along a little faster. There’s even scope for the Bank Rate to drop even further, to 0%, by the turn of next year.

Evolution Money is a non-LTV lender offering secured loans from £1,000 – £20,000 to clients with zero or restricted equity and mortgage arrears. Read more about our loan service and how we can help you today.

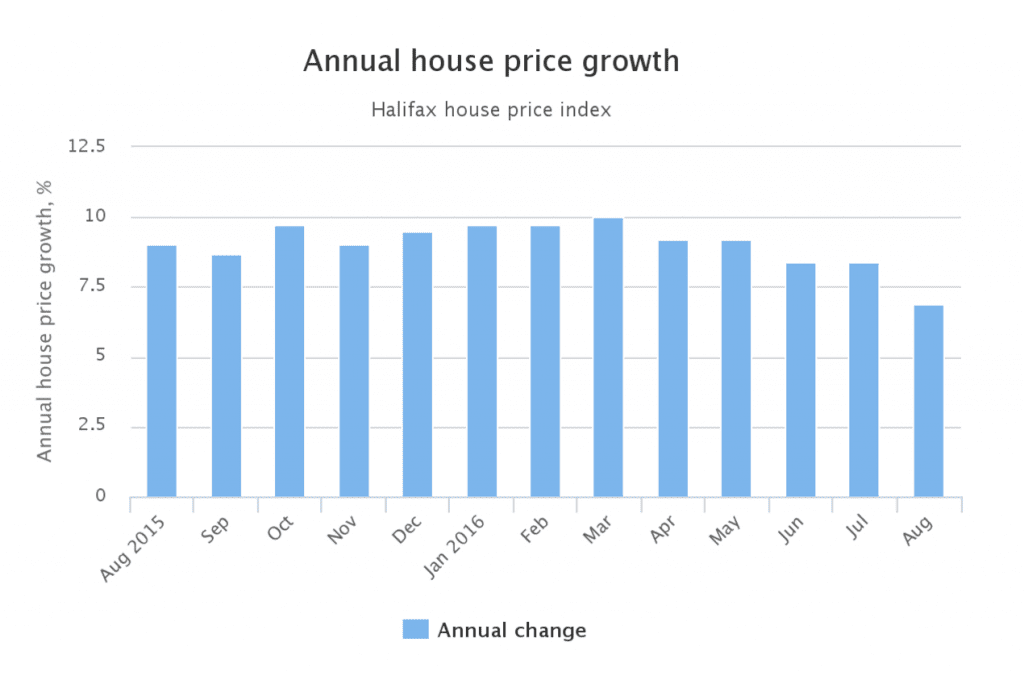

House prices in the UK have continued to follow the trend of recent months, falling in August by 0.2% overall. This follows a sizable drop in July of 1.1%, which means that the average UK house price now sits at £213,930.

The figures, released by banking giant Halifax, clearly show that activity in the housing market has dropped off since the early months of the year. This news follows a survey by the Royal Institution of Chartered Surveyors (Rics) last month that revealed a record low number of homes listed on the market, and the lowest quarterly growth since December 2014.

The post-Brexit factor

Confidence in the housing market was widely expected to wane following the Brexit referendum, with many buyers and sellers deterred from entering the market altogether.

This, coupled with increasing prices in the early months of 2016, has caused the drop off in sales that we are now seeing. And as both demand and supply for houses drops, so does the average market price.

The below chart shows the decrease in annual house price growth between June and August:

The impact for house buyers and sellers

If you’re considering buying a house as the market reaches a ‘low point’ be mindful that, although you may be more likely to find a bargain, your options are bound to be far more limited than at other points in the year.

On the other hand, homeowners looking to sell are likely to prefer to wait until the market price picks up before listing their property on the market.

Always remember to take seasonality into account. As a rule of thumb, spring is usually the most active month for buyers and sellers in the housing market; whereas summer and winter are comparatively quiet.

A downturn during July and August isn’t all that surprising during the ‘holiday’ months, and we’d expect the appetite for buying homes to pick up for a month or two as we enter autumn. The revived demand in September and October tends to be caused by buyers who are in a rush to move into a new home prior to the festive season. However, there tends to be very little activity between October and January.

The longer term forecast

Despite the current downturn, housing experts say that confidence in the housing market will gradually return following the initial post-Brexit shock. Some also maintain that a long term increase in prices is on the horizon – a 3.3% increase over the next five years according to Rics.

Evolution Money is a non-LTV lender offering secured loans from £1,000 – £20,000 to clients with zero or restricted equity and mortgage arrears. Read more about our loan service and how we can help you today.

Representative 21.54% APRC (Variable)

For a typical loan of £12,000 over 60 months with a variable interest rate of 21.54% per annum, your monthly repayments would be £310.60. This includes a Product Fee of £1,200.00 (10% of the loan amount) and a Lending Fee* of £763.00, bringing the total repayable amount to £18,635.80. Annual Interest Rates range between 8.6% to 27.87% (variable). Maximum 50.00% APRC. *Lending Fee varies by country: England & Wales £763, Scotland £1,051, Northern Ireland: £1,736.

Think carefully before securing debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage or any other loan secured against it. If you are thinking of consolidating existing borrowing, you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.