All you need is love...and money!

Of Love & Money: Valentine’s Day in the UK

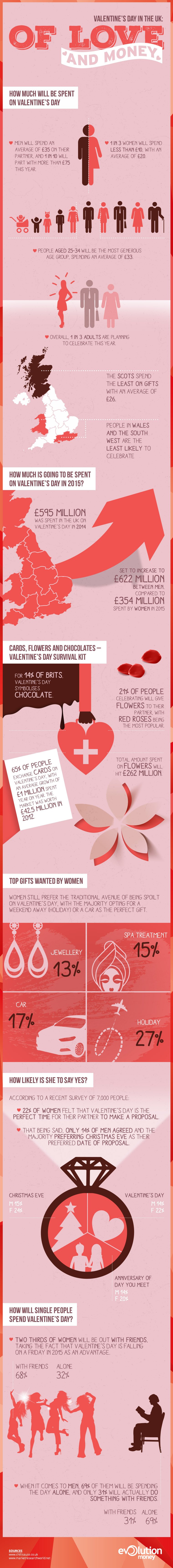

It wasn’t that long ago that Valentine’s Day meant buying a card for your loved one and perhaps a bunch of flowers or a box of chocolates. Not anymore. Exactly how much we British spend on Valentine’s Day varies depending on the survey you look at, but whichever one you choose, the days of a simple card and a box of chocolates being sufficient on the 14th of February seem to be long gone. On average, men spent £40 on their partner on Valentine’s Day, whereas women spent an average of £24.

And we don’t just spend money on our partners on Valentine’s Day. In the US, 15 per cent of women send themselves flowers, and an incredible $231 million is spent on pets. Here in the UK, sales of lingerie double in the run-up to V Day. Jewellery sales peak on the 8th of February – not surprising, when you think that ten per cent of all marriage proposals happen on Valentine’s Day.

Looking through the infographic, we break down for you how much is going to be spent in 2015 on Valentine’s day, the most generous age bracket, and what are some of the most popular gifts that are bought to celebrate the day.

Coming not long after Christmas and the New Year, Valentine’s Day can be an additional, expensive event. If you find it difficult to afford the cost of Valentine’s Day celebrations due to current debts, you may wish to consider looking at debt consolidation loans.

Secured loans allow you to borrow money against assets you already own. Consolidating existing debts could reduce your monthly payments by allowing you to combine multiple debt payments with various lenders into one manageable monthly amount.

Representative 21.54% APRC (Variable)

For a typical loan of £12,000 over 60 months with a variable interest rate of 21.54% per annum, your monthly repayments would be £310.60. This includes a Product Fee of £1,200.00 (10% of the loan amount) and a Lending Fee* of £763.00, bringing the total repayable amount to £18,635.80. Annual Interest Rates range between 8.6% to 27.87% (variable). Maximum 50.00% APRC. *Lending Fee varies by country: England & Wales £763, Scotland £1,051, Northern Ireland: £1,736.

Think carefully before securing debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage or any other loan secured against it. If you are thinking of consolidating existing borrowing, you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.